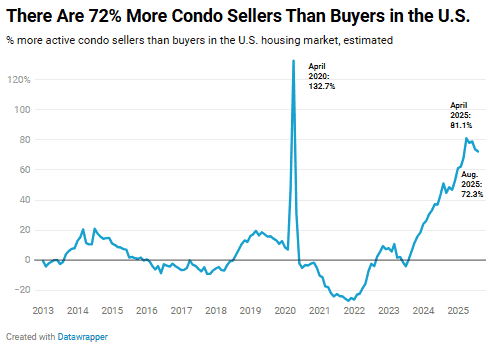

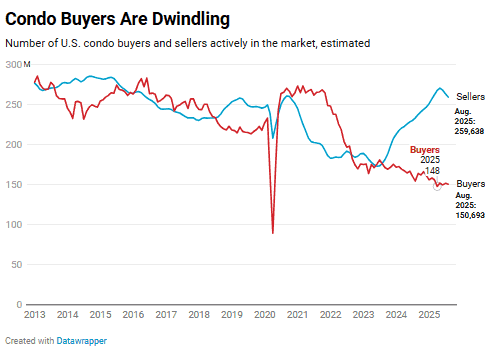

In August 2025, there were 72.3% more condo sellers than buyers across the U.S. According to Redfin’s recent report the U.S. condo market is seeing one of its most buyer-friendly periods in over a decade, 259,638 sellers versus 150,693 buyers. And five of the ten most oversupplied condo markets are right here in the Sunshine State, including Miami, Fort Lauderdale, West Palm Beach, Tampa, and Jacksonville. For buyers who can afford it, the window to negotiate better condo deals is wide open.

What’s Causing the Condo Oversupply Across the U.S. and Florida?

According to Redfin data, the condo market has experienced an oversupply for five consecutive months, reaching its widest gap of 81% in April 2025. The only time the imbalance was greater was in April 2020, when the pandemic brought homebuying to a standstill. Redfin classifies a buyer’s market as one with at least 10% more sellers than buyers, and the current 72% surplus marks the strongest buyer’s condo market since 2013.

Florida has roughly 1.5 million condos, accounting for about one-fifth of all U.S. condos. Not surprisingly, it also leads in overstocked markets:

-

Miami: 11,486 sellers vs. 3,270 buyers (251% more sellers)

-

Tampa: 5,183 sellers vs. 1,519 buyers (241% more sellers)

-

Fort Lauderdale: 10,517 sellers vs. 3,300 buyers (218% more sellers)

-

Jacksonville: 1,808 sellers vs. 578 buyers (212% more sellers)

-

West Palm Beach: 6,847 sellers vs. 2,359 buyers (190% more sellers)

These areas are experiencing an oversupply of condos on the market, with too few buyers to keep up with the available inventory.

HOA Fees, Insurance, and Special Assessments

Owning a condo in Florida has become increasingly costly as rising HOA dues, higher insurance premiums, and new special assessment rules push many potential buyers out of the market. Following the 2021 Surfside condo collapse, the state implemented stricter inspection requirements for older buildings and mandated higher reserve funding for future repairs. While these measures aim to enhance safety, they have also driven up monthly maintenance fees, leading many buyers to shift their interest toward single-family homes and townhouses instead.

Mortgage Rates & Affordability Concerns

Condo prices have dipped only marginally, with the median sale price at $350,000 in August, down 1% year over year. However, rising interest rates have doubled monthly mortgage payments compared to pre-pandemic levels, putting homeownership out of reach for many buyers.

South Florida’s Aging Condo Inventory Is a Problem

Older Buildings Turning Off Buyers

Many of South Florida’s condos, built in the 1960s and 1970s, feature outdated elements such as popcorn ceilings, low ceilings, and outdoor catwalk-style hallways. Coupled with rising maintenance costs and aging infrastructure, these factors are making buyers hesitant to invest in these older properties.

Demand Shifting to Newer Construction

Luxury developments with upgraded finishes, better amenities, and stricter compliance are faring better. These appeal to higher-income buyers who are less sensitive to rising monthly costs.

FAQs About the South Florida Condo Market

Why is there a condo oversupply in South Florida in 2025?

South Florida Condo Market is seeing a major condo oversupply due to rising HOA fees, increased insurance costs, new safety regulations, and declining investor demand. Many sellers are listing at the same time that buyer demand is slowing.

Are South Florida condo prices dropping in 2025?

Prices are mostly stable. As of August 2025, the median sale price of a U.S. condo was $350,000, down just 1% year over year. While prices haven’t fallen sharply, sellers are more open to price cuts and concessions.

What risks should I look out for when buying a condo in Florida?

Buyers should be cautious about special assessments, low HOA reserves, and rising monthly fees. Always request financials and inspection reports from the condo association before making an offer.

Are new or pre-construction condos safer to buy in South Florida?

Pre-construction and newer condos often have better amenities, comply with updated building codes, and attract higher-end buyers. They can be a good choice if you’re comfortable waiting for completion and can meet down payment requirements.

A Rare Window for South Florida Condo Market Buyers

The South Florida condo market is experiencing a rare shift in power toward buyers. With inventory piling up and sellers more willing to negotiate, 2025 could be a prime year to buy, especially in oversupplied markets like Miami and West Palm Beach.

But this window may not stay open forever. As some sellers pull listings and new regulations normalize, buyer leverage could shrink.

If you’re thinking about buying or selling a condo in South Florida, get expert advice from people who know the local dynamics. Contact The Mastropieri Group Realtors® at (561) 544-7000. As trusted South Florida real estate agents, we help clients make smart decisions in a changing market.

Posted by Larry Mastropieri on

.webp)

Leave A Comment