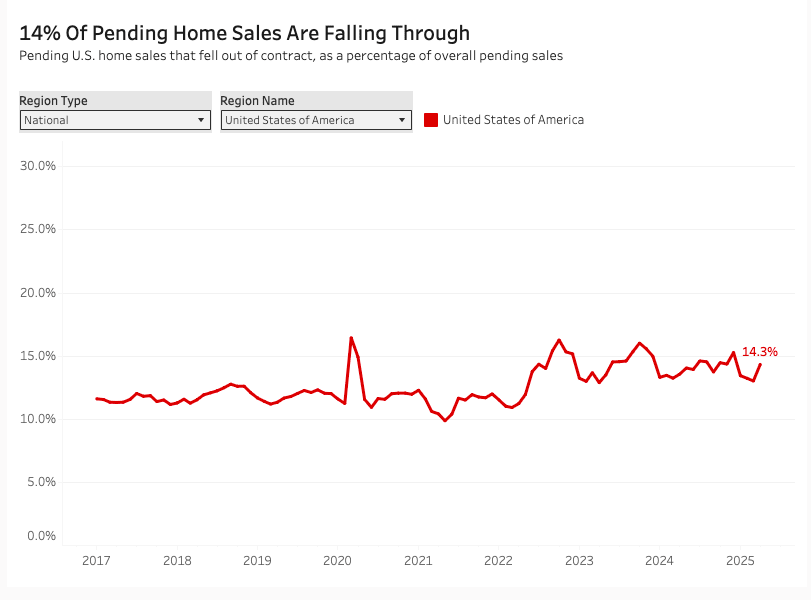

The U.S. housing market is sending mixed signals in 2025. While some metrics show resilience, a worrying trend has emerged: more home sale cancellations are happening across the country. In May alone, nearly 6% of pending contracts fell through, according to the NAR home sales report. That’s up from 5% a year earlier. And data from Redfin housing data shows an even sharper picture: 14.6% of pending sales were canceled, the highest May rate since at least 2017.

So what’s behind the spike? And what does this mean for South Florida buyers and sellers?

What’s Causing the Spike in Home Sale Cancellations This Year?

Several factors are putting pressure on housing deals in 2025:

-

Stock Market Fluctuations and Economic Worries

Volatility in the financial markets and concerns about inflation have shaken buyer confidence. This affects credit approvals, down payment funds, and willingness to commit, often leading to home sale cancellations.

-

Mortgage Rate Volatility

While rates have dropped slightly from early highs, the average 30-year mortgage still hovers around 6.5%, per Fannie Mae. Some buyers are pulling out when they realize the monthly payments no longer fit their budget, resulting in canceled real estate contracts.

-

Low Appraisals and Failed Inspections

Buyers may agree to a price, but if a home appraises for less or an inspection reveals issues, deals fall apart. This is especially common in hot markets like South Florida, where bidding wars sometimes lead to offers above market value and eventual home sale cancellations.

Understanding Home Sale Cancellations

In a typical housing market, about 3% to 5% of pending home sales fall through before closing. These cancellations usually happen due to financing issues, failed inspections, or unexpected life changes. While that baseline has remained steady over the years, recent shifts in the economy and buyer behavior are changing that pattern.

In 2025, the rate of canceled real estate contracts is moving upward. According to the latest reports, more buyers are backing out of deals—especially in highly competitive markets where bidding wars and inflated prices are common. When homes don’t appraise at the offered price or buyers run into financing trouble, deals collapse.

Compared to May 2024, home sale cancellations are noticeably higher. This is now the third consecutive month showing an annual increase in failed contracts, highlighting a developing trend rather than a temporary blip. The data points to growing buyer caution, market unpredictability, and an affordability squeeze that’s affecting closings across the country.

What the Data Says

According to Redfin housing data, 14.6% of all pending home sales in May 2025 didn’t make it to closing. That’s a jump from 14% the year before. Meanwhile, the NAR home sales report shows a 6% cancellation rate for the same period.

Pending sales rose slightly (1.8%) from April to May 2025 and are up 1.1% compared to last year. But home sale cancellations are overshadowing this growth.

Fannie Mae's Market Outlook

Fannie Mae expects existing home sales to hit 4.14 million this year, a 2% rise. But that’s a downgrade from the previous forecast of 4.24 million homes. They're predicting a 9.5% jump in 2026, assuming rates drop closer to 6.1%.

How Home Sale Cancellations Affect Buyers and Sellers

For Buyers:

-

Lost inspection/appraisal fees

-

Missed opportunities on other homes

-

Damaged credit from financing withdrawals

For Sellers:

-

Extended time on market

-

Perception issues with re-listed homes

-

Financial planning disruptions

For the Market:

More home sale cancellations mean slower closings, uncertain inventory levels, and wider gaps between list and sale prices. Buyers are more cautious, and sellers may need to adjust their pricing expectations.

What This Means for the South Florida Market

In areas like Boca Raton, Fort Lauderdale, and Delray Beach, national trends are being felt locally. High demand, fluctuating rates, and inflated pricing are all contributing to more home sale cancellations.

South Florida remains a desirable market, but buyers are being more selective. Inspections, appraisals, and financing hurdles are more likely to derail deals.

How to Protect Your Deal From Falling Through

Tips for Buyers:

-

Get pre-approved (not just pre-qualified) for a mortgage

-

Keep credit stable and avoid large purchases

-

Hire a top-rated home inspector

-

Don’t overbid beyond appraised value

Tips for Sellers:

-

Price your home realistically using recent comps

-

Disclose known issues early

-

Be prepared to negotiate on inspection findings

-

Work with an experienced agent to screen buyers

Work With a Trusted Team Who Understands the Market

Though the market is showing signs of slight improvement, real estate trends 2025 suggest that uncertainty will linger. Buyers and sellers alike should expect more due diligence, slower processes, and potentially more canceled deals.

If you're buying or selling in South Florida, you need a team that knows how to keep deals on track. Call us today at (561) 544-7000 or visit us The Mastropieri Group, Realtors® to get expert guidance tailored to your goals. As trusted real estate agents in South Florida, we're here to help you succeed in today’s market.