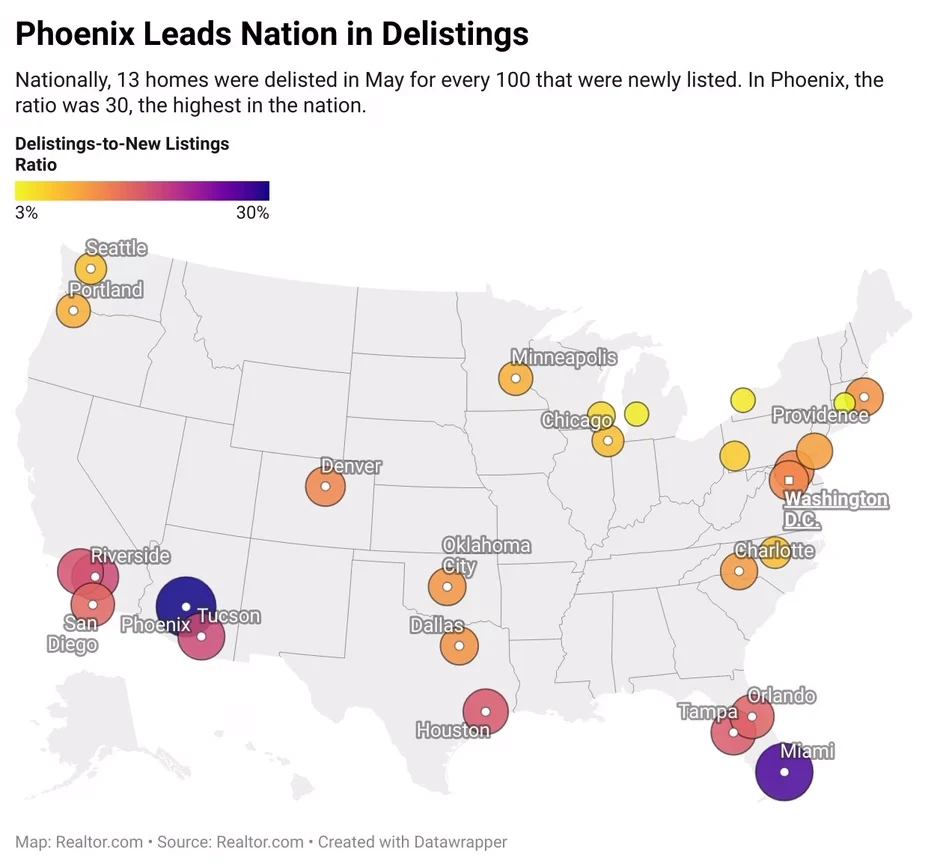

A growing number of homeowners are choosing to pull their listings from the market. Nationwide, delistings jumped 47% year-over-year in May, according to a recent Realtor.com report. In South Florida, the effects are beginning to show, especially in cities like Miami, where median home prices have dropped by nearly 5% year-over-year.

Across the country, sellers are stepping away from the market rather than lowering their prices. With historically low mortgage rates and high home equity, many feel no urgency to sell at a discount. Sellers remain fixed on peak-pandemic price expectations, while buyers are facing higher interest rates and greater inventory.

This mismatch in pricing and willingness to negotiate has created a standoff. As a result, many listings are either stagnant or being pulled. Having gained significant equity during the boom years, most sellers feel empowered to wait until conditions shift in their favor, rather than accept lower offers. Many sellers bought before or during the pandemic boom and saw their equity soar. With no pressure to sell and no financial strain, they are using this flexibility to hold out for top dollar or simply wait for better conditions.

South Florida Real Estate Market 2025

How South Florida Compares to National Trends

In the South Florida real estate market 2025, trends mirror national data but are magnified due to the area's fast-paced growth and investment-driven sales. The region saw a nearly 30% increase in inventory, according to national housing reports, yet the number of delistings is outpacing new listings.

Price Drops and Inventory Growth in South Florida

In markets like Broward County, prices are beginning to slip, while inventory has grown significantly. Sellers hoping for 2021 prices are finding fewer offers and more competition. According to Florida Realtors, active listings are at their highest point since 2020.

Which South Florida Cities Are Seeing the Most Delistings?

-

Miami: Median list prices down 4.7%, high delisting rates

-

Fort Lauderdale: Rising days on market, sharp inventory increase

-

West Palm Beach: More than 1 in 5 listings have had a price cut in June

These conditions are pushing many sellers to wait rather than negotiate.

Buyer Opportunities in a Shifting Market

Buyers now have access to a wide range of homes, especially in mid-tier and luxury price points. The market is no longer as cutthroat, giving buyers more negotiating power.

How Buyers Can Use Price Cuts to Their Advantage

With 20.6% of listings nationally featuring price reductions, this is a prime time to negotiate. Buyers should:

-

Track listings with price cuts

-

Work with a local agent to identify overvalued properties

-

Make offers slightly below asking price where appropriate

Median List Prices and Days on Market in South Florida

In South Florida, median days on market have risen to 53, matching pre-pandemic norms. This means buyers have more time to make informed decisions without rushing into bidding wars.

What Sellers Should Know Right Now

Pricing Strategies in the Current Market: If you plan to sell, be realistic about your asking price. Review comparables and consider pricing slightly below peak to attract attention and offers.

The Risks of Overpricing and Waiting Too Long: Overpriced homes sit longer and risk needing multiple reductions. Worse, homes that linger may be delisted, missing the chance to sell in a still-active market.

Delisting can work if:

-

You’re not in a rush to sell

-

You want to avoid lowering your price

-

You can wait for market conditions to improve

Discuss the pros and cons with your real estate agent before pulling your listing.

Working With the Right Real Estate Agent Matters

A knowledgeable South Florida real estate agent can help you:

-

Analyze current trends

-

Set a competitive price

-

Avoid unnecessary price reductions

Why You Need a South Florida Real Estate Agent Who Knows the Trends

Every neighborhood has its own pace and pricing quirks. The right agent knows which areas are cooling, where inventory is surging, and how to price accordingly.

Frequently Asked Questions: South Florida Real Estate Market 2025

-

What does a home delisting mean for buyers?

For buyers, delistings can be a sign that sellers are holding firm on pricing. However, they also signal that inventory levels are growing, giving buyers more leverage and time to make decisions in the South Florida real estate market.

-

Are delistings a sign the market is crashing?

No, delistings are more a sign of a market correction than a crash. Sellers are adjusting their expectations after the pandemic boom, and the market is shifting toward more balanced conditions.

-

How do rising delistings affect home prices in South Florida?

Rising delistings usually indicate that homes are overpriced. As more listings are removed, it reduces immediate supply, but can also lead to more price reductions in the long run if sellers re-enter with more realistic pricing.

-

Should I buy a home in South Florida in 2025 or wait?

With rising inventory and more price cuts, 2025 is shaping up to be favorable for buyers. If you’re financially ready, now is a good time to explore options and negotiate more favorable terms.

-

Is it smart to delist my home and try again later?

Delisting might make sense if you’re not in a rush to sell and want to avoid price reductions. However, market conditions could change, so it's best to discuss timing with a trusted real estate agent in South Florida.

-

Are some South Florida cities affected more than others?

Yes. Cities like Miami, Fort Lauderdale, and West Palm Beach are seeing more price cuts, longer days on market, and higher delisting rates compared to other areas.

-

Will inventory continue to rise in 2025?

According to current trends, inventory is expected to keep rising in the short term. This could continue to ease pressure on buyers and create opportunities to negotiate better deals.

Final Thoughts on the South Florida Real Estate Market 2025

The South Florida housing market is experiencing a reset. With more inventory, rising delistings, and buyers regaining leverage, it's no longer business as usual for sellers. At the same time, motivated buyers have new opportunities to find better value.

Ready to move forward with confidence? Visit the Discover South Florida blog for expert insights, or call The Mastropieri Group, Realtors® at (561) 544-7000 to speak with a trusted local advisor who can help you make the smartest real estate decisions in today's market.